Paxos Survey Finds Consumers Want Easier Access to Crypto

Allison Whaley

Feb 9, 2022

Crypto continues to trend towards mainstream adoption. Now more than ever, consumers are purchasing crypto, despite the market’s ongoing volatility. And while this dynamic benefits the crypto industry, consumer adoption creates a “flight of capital” from financial institutions as more customers transfer money out of traditional banking and investment accounts.

To help quantify and better understand consumer behavior as it relates to crypto purchasing habits, Paxos conducted a statistically significant survey of crypto owners in late 2021.

Survey Methodology

Paxos surveyed more than 1,000 crypto owners. We asked survey participants a series of questions to identify their crypto buying habits. These questions included details of their first crypto purchase, venue of purchase, how often they purchased and beyond. The standards of the survey were designed so that these individuals were neither super-users of crypto, nor were they new to the asset class.

Notable Findings

The survey results indicate a shift of behavior and demographics worth noting for the financial industry. Here are three of our six top takeaways. Download our report to see the full results.

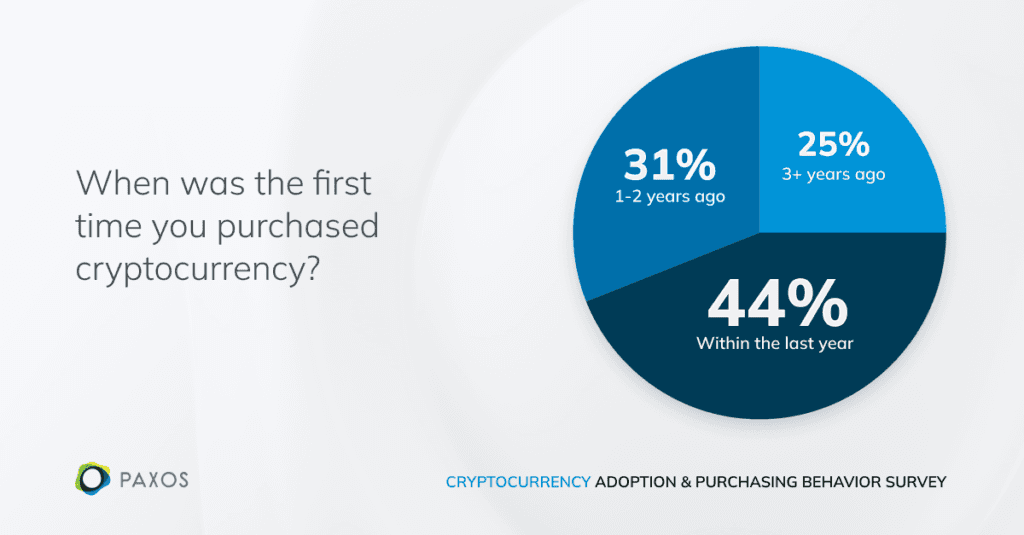

More than 40% of crypto owners purchased their first digital asset in 2021.

With 44% of survey respondents making their first crypto purchase within the past year and 31% within the past 2 years, crypto is transitioning from just a small set of early enthusiasts to a much larger population of consumers as it moves towards mainstream adoption. The survey also found that 62% of respondents are very likely to buy or sell crypto in the next two years, showing that a majority of these new crypto owners plan to stay engaged in the ecosystem beyond their initial purchase.

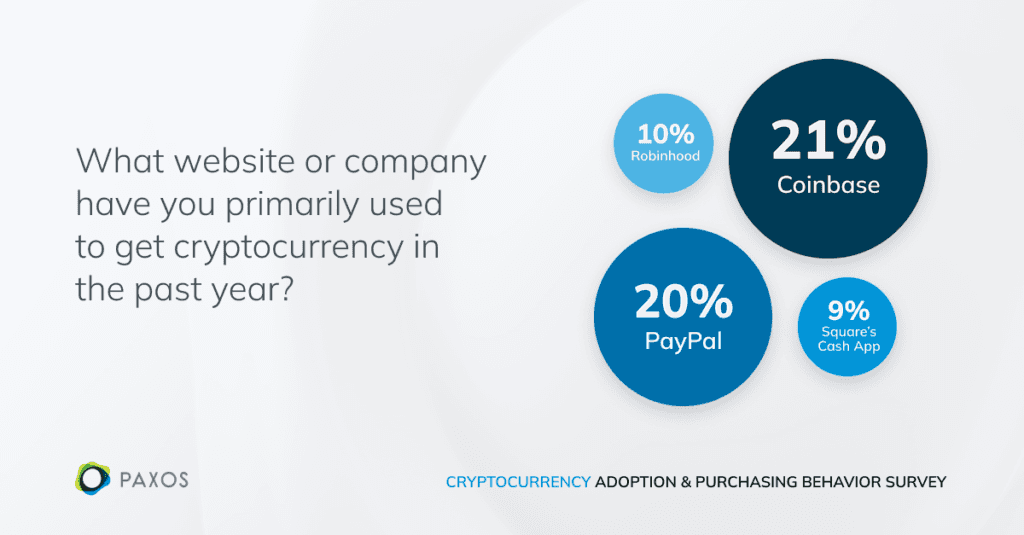

Three out of the four top platforms cited were mainstream, established financial services apps.

While Coinbase led the way at 21%, three out of the four top platforms (PayPal, Robinhood and Square’s Cash App) were mainstream, established financial services apps. As more everyday consumers enter the crypto ecosystem, this indicates that crypto investors are inclined to first engage with platforms they already know and trust, versus platforms that are solely crypto exchanges.

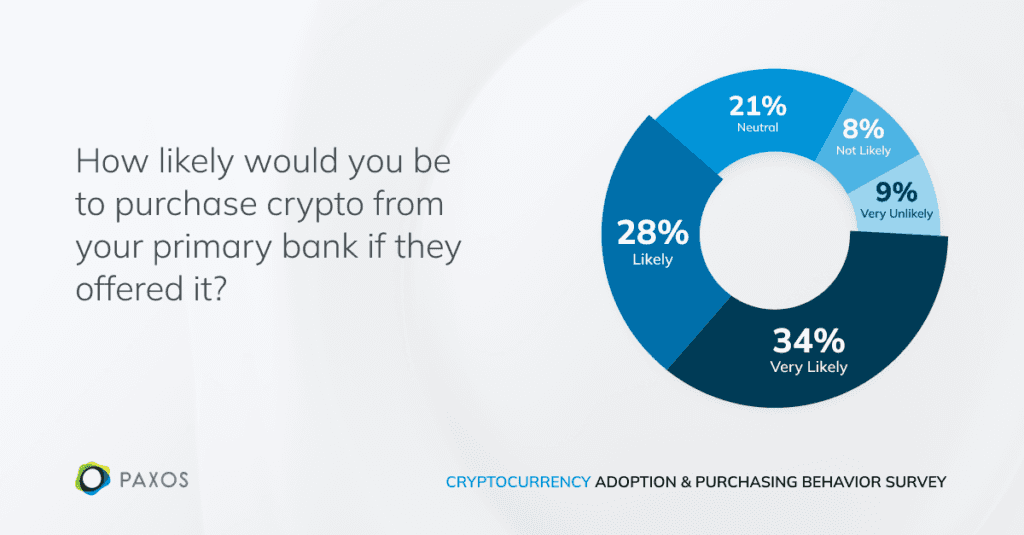

More than 60% of crypto owners stated that they would purchase crypto from their primary bank if that option existed.

Given a majority of crypto owners (62%) surveyed would purchase crypto from their primary banking app if offered, the world’s consumer banks have a huge, untapped opportunity in crypto to meet the needs of their existing consumers. As the ecosystem grows, this new asset class could become an active tool to deepen existing customer relationships and drive new customer acquisition.

For the rest of the results, make sure to download the full report.

Crypto Represents an Untapped Opportunity for the Consumer Banking System

The survey results solidified that a “flight of capital” is indeed taking place as more consumers join the crypto ecosystem, but it also identified that today’s crypto owner is shifting from a set of niche, early adopters towards the everyday consumer.

Beyond the survey results, market trends also indicate that crypto ownership and purchasing habits are shifting, with companies like Robinhood reporting in Q2 2021 that it was “the first quarter where a larger share of new customers placed their first trade in crypto rather than equities.” Square’s Cash App also reported that more than a million customers had purchased Bitcoin for the first time in January 2021, further demonstrating how today’s crypto owner is shifting from a set of early adopters to mainstream consumers. With companies like Square and Robinhood experiencing these behavior shifts, it should come as no surprise that 2021 was a year of incredible growth for the crypto ecosystem as worldwide adoption jumped over 880%.

As the financial ecosystem evolves further in 2022 and crypto adoption continues to increase, financial institutions have an unprecedented, untapped opportunity to continue serving those consumers by becoming a part of the crypto ecosystem. Not only can crypto capabilities keep consumer assets on the balance sheet, but crypto also has the potential to increase the number of consumers on the platform. If you want to dive deeper into our results and what they could mean for the future of your business, download the full report.

The content of this blog post was prepared for informational purposes only and does not represent investment advice. For full disclaimer, download the report.