Surging Interest Indicates Cryptocurrency is Becoming the Latest Wealth Accumulation Vehicle

Paxos

Feb 9, 2022

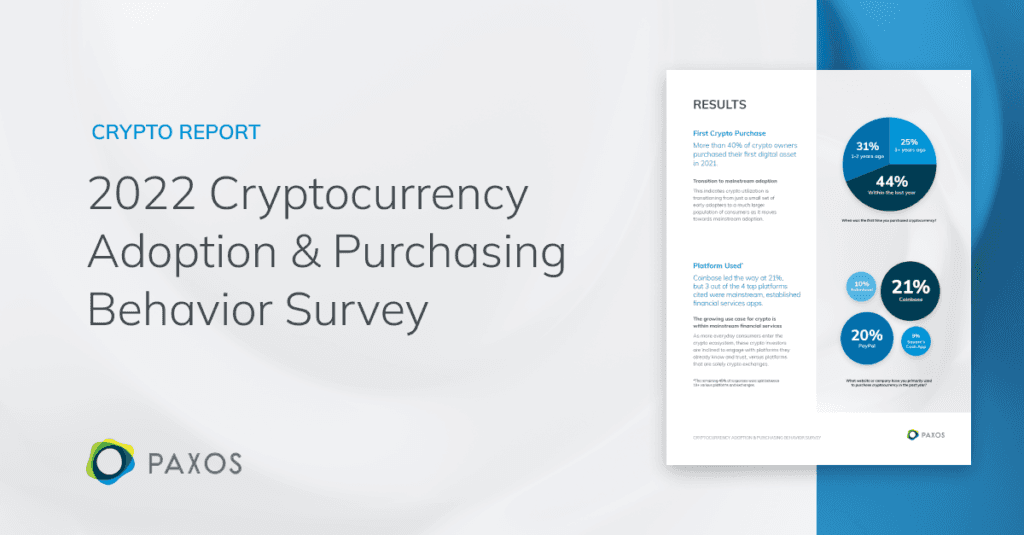

New survey from Paxos shows scale of crypto opportunity for financial institutions

NEW YORK – February 9, 2022 – Everyday consumers in the U.S. are viewing and treating cryptocurrency as a sound investment vehicle versus a get-rich-quick scheme – and are looking to established financial institutions to support their crypto ambitions. According to new survey data from Paxos, the world’s leading regulated blockchain infrastructure platform, 62 percent of current crypto holders say that, if their bank offered a crypto investment functionality, they would take advantage of it.

Contrary to popular narratives, crypto trading is no longer the hobby of a small group of enthusiasts and is, in fact, growing increasingly mainstream. Forty-four percent of respondents made their first crypto purchase within the past year, and another 31 percent within the past two years. In addition, 56 percent say they are very likely to buy or sell crypto in the next two years. Crypto holders are also pulling money from traditional, “safer” vehicles to fund their holdings: Thirty percent of respondents say they have used money from their savings accounts, while 25 percent have transferred money out of their investment accounts.

But financial institutions have the opportunity to not only recapture the dollars fleeing from their platforms, but to also increase engagement and stickiness with their customers. Crypto, as a relatively young asset class, is volatile and likely will remain so as more assets become available and more investors enter the market. Unlike traditional investments, crypto holders rarely “set it and forget it” when trading crypto – they tend to engage more as there are constant developments and opportunities to learn about the evolving space.

The survey data suggests crypto owners are doing just that, with 35 percent of respondents saying that they’ve traded crypto once or twice per month over the past year, and 23 percent saying they’ve done so at least once per week. In other words, financial institutions that effectively incorporate crypto trading capabilities into their platforms will likely see the frequency with which their users log into – and engage with – the platform increase. At the same time, they will be able to capture a piece of the growing and lucrative digital currency pie.

“Our survey shows people want to engage with digital assets through their existing, trusted service providers,” says Walter Hessert, Head of Strategy at Paxos. “That’s a massive opportunity for institutions, fintechs and the financial system as a whole. With the Paxos infrastructure platform, enterprises can easily enable crypto offerings fully embedded in their own applications. We are continually seeing these offerings drive engagement and customer acquisition for our partners.”

Beyond the core findings of Paxos’ Cryptocurrency Adoption & Purchasing Behavior Survey, interesting insights also included:

Crypto is proving to be more accessible than traditional investments. Crypto is often the first foray into investing for many respondents, with more than a third (34 percent) of crypto holders saying their only other investment in the stock market to date is through 401(k)s or retirement accounts. What’s more, 39 percent of respondents use standard debit cards to deposit U.S. dollars into their crypto wallet – the most common means for doing so. Few traditional investments offer this option.

With crypto, men tend to be the more active traders. Men are more likely to trade crypto at least once per week (28 percent, versus 18 percent of women), with those aged 35-44 being particularly active (32 percent). They are also more likely to use any leftover money from their paycheck to fund crypto purchases (53 percent of men compared to 40 percent of women). In contrast, women say they would rather use an unexpected windfall, such as a gift or bonus, to fund other purchases.

Women much prefer to get crypto from a more established fintech app. Platforms like PayPal are more sought out by women to buy and sell crypto – 24 percent, versus 16 percent of men. Men are more likely to use a dedicated crypto exchange like Coinbase. In terms of how crypto holders would like to see their digital currency factor into their everyday financial lives, women would prefer that their banks or credit card issuers offer cashback in crypto (24 percent). Men, however, would prefer the ability to trade crypto (30 percent), suggesting that men are more interested in the growth opportunities crypto presents than its practical applications as a payments method.

###

About Paxos’ Cryptocurrency Adoption & Purchasing Behavior Survey

Paxos partnered with research firm Pollfish to survey more than 1,000 U.S. adults ages 18 or older who both own crypto and have a primary banking account with a known financial institution. The survey was conducted in Q4 2021.

About Paxos

Paxos is the leading regulated blockchain infrastructure platform. Its products are the foundation for a new, open financial system that can operate faster and more efficiently. Today, trillions of dollars are locked in inefficient, outdated financial plumbing that is inaccessible to millions of people. Paxos is replatforming the financial system to enable assets to instantaneously move anywhere in the world, at any time, in a trustworthy way.

Paxos uses technology to tokenize, custody, trade and settle assets. It builds enterprise blockchain solutions for institutions like PayPal, Interactive Brokers, Meta, Mastercard, MercadoLibre, Bank of America, Credit Suisse, Societe Generale and Revolut. Paxos is a top-funded fintech company with more than $540 million raised from leading investors including Oak HC/FT, Declaration Partners, Founders Fund, Mithril Capital and PayPal Ventures. With offices in New York, London and Singapore, Paxos takes a global approach to modernizing the financial system.

Press Contact

Meghan Warren

meghan.warren@aspectusgroup.com

(347) 766-4589