Gold has frequently been viewed by investors as a “safe haven” asset – an attractive, timeless store of value amid market risk. As the geopolitical landscape shifts, inflation concerns flare, and uncertainty continues to rattle markets, we thought it was the right time to step back and get a pulse on the average gold investor’s attitudes across a wide range of issues.

Investors’ demand for gold in all forms has spiked in the past few years, but cost, knowledge, and trust impediments remain that keep gold as a relatively modest part of portfolios. While traditional physical gold investing has attracted first-time buyers, tokenized gold is showing signs of growth, especially among the younger generations. We surveyed 1,000 adults in the US, UK, Singapore and Germany who have purchased some form of gold – be it ETFs, physical bars, gold coins or tokenized gold in the past two years – to understand their attitudes about the market, their motivations, and their thoughts on the future.

Inflation is attracting new gold investors

Gold has long been of interest, with 20% of respondents first purchasing gold prior to 2010. But enthusiasm from new buyers has increased in recent years, with the majority (60%) of first-time buyers purchasing since 2015 and one-quarter purchasing for the first time since 2020. While concerns about the equities market, crypto market, and the volatile geopolitical climate are on everybody’s minds, most respondents cited concerns about inflation as the primary purchase motivation.

However, those looking to gold as a safe haven hedging against inflation should consider which formats they purchase. As I mentioned in my recent post “Speed & Ease are More Crucial Than Ever When Buying Gold,” investment products like derivatives, ETFs and futures contracts are not a substitute for full ownership of investment grade gold, including investment-grade gold backed tokens, as a store of value in times of volatility, uncertainty or crisis.

Are people buying physical gold or digital gold?

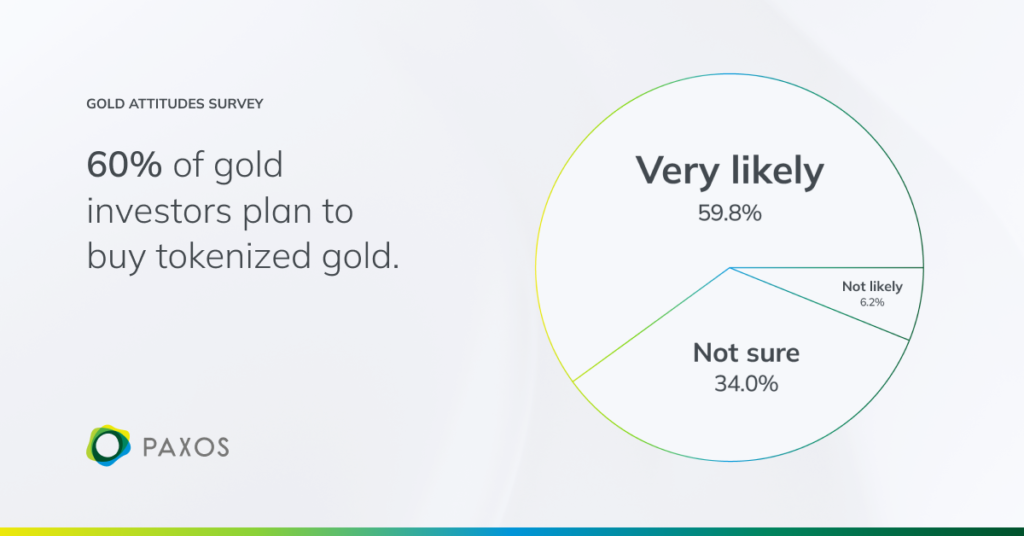

Physical gold remains the dominant product as almost all respondents bought gold allocated bars or coins, while only 38% bought digital or tokenized gold products like Paxos’ PAXG. The younger generation is significantly more attracted to digital gold. Not surprisingly, investors 45 and older are more resistant to tokenized gold, as only 23% purchased digital gold in the past five years, while 43% of those 18-34 purchased digital. Gold ETFs are the top single gold product, especially among the 18 to 34 crowd of whom 60% have invested in them. The generation gap persists here, as only 45% of those over the age of 44 opted for ETFs.

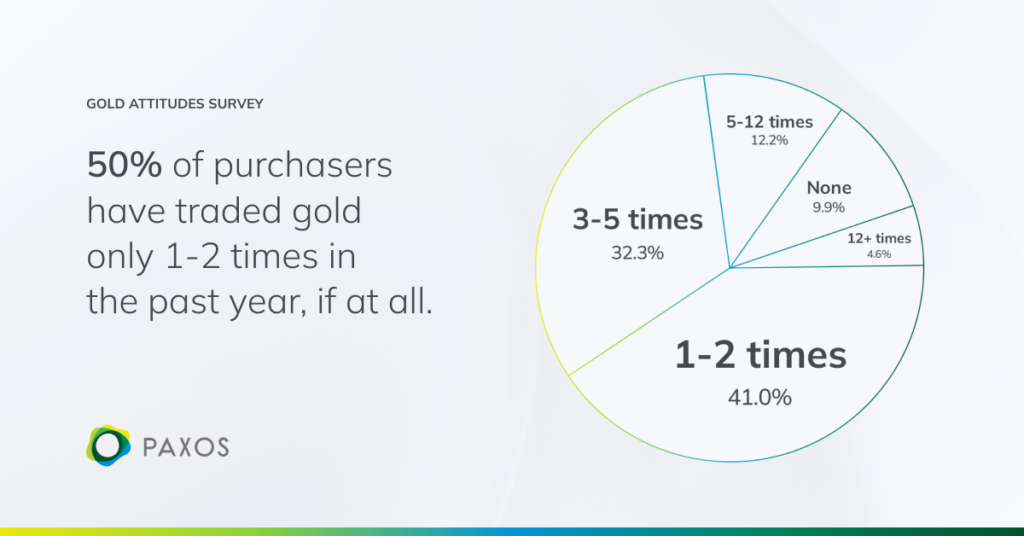

Further, when people buy gold in any format, they tend to hold it. Fifty percent of purchasers have traded gold only 1-2 times in the past year, if at all. And when they do trade gold, the average deal size is relatively small, with 43% of investors trading $0-$10,000 per transaction, and 80% of investors trading up to $250,000 per transaction.

Costs and knowledge are the main barriers to gold investment

While interest is increasing, gold remains a minority portion of most investors’ portfolios. Gold represents 20% or less of most investors’ portfolios. Despite the prevalence of new gold formats including tokenized gold, perceived barriers to purchase remain. For physical gold coins and allocated bars, storage costs and minimum purchase costs lead the list of perceived barriers, followed by a general lack of knowledge around the asset class – where and how to purchase, store, and move (physical) gold, as well as its tax implications.

When it comes to purchasing tokenized gold, cost is still an obstacle, but trustworthiness and uncertainty are the top two concerns for buyers. With a new technology, people are naturally facing a demystification process that can only come with more education. From being uncertain about how and where to purchase to not knowing if it’s safe, gold investors, especially older ones, display resistance, which is understandable considering that physical gold traditionally represents a safe, attractive store of value. Further complicating purchasing is the fact that 10% of respondents do not yet have a digital wallet, which would be a prerequisite for purchasing and holding tokenized gold.

If the barriers fall, investors will come

The fact is, investors want to buy gold. Forty-six percent plan to buy gold or hold the gold they have (27%). Plus, if these barriers were removed, people would be significantly more likely to purchase gold: A full two-thirds of investors say they would be very likely to buy. As with physical gold, if perceived barriers to purchasing tokenized gold were removed, 58% of investors say they would be significantly more likely to purchase more. If the gold industry can demystify both physical and digital gold investing to build trust and certainty, a tremendous opportunity exists.

There is a wild card in the mix as well. The popularity of Bitcoin is poised to affect the market, with 33% of respondents saying “Bitcoin is the new gold,” and they plan to purchase more of it, instead of gold. Once again, a generation gap appears as 43% of those 18-24 plan on purchasing Bitcoin instead of gold, while only 19% of investors over 45 have the same intention.

With unpredictable geopolitical, global health, and economic forces continuing to roil the markets, the demand for the relative stability of gold investments as attractive assets will continue to increase. Additionally, if the industry can shine a light on the black box of gold investing for those who want to buy but don’t feel the confidence and trust, then perhaps more people will buy and will make gold a larger part of their portfolios.