Blog

Featured Articles

An Introduction to Paxos’ Stablecoin Payments Platform

Stablecoin Policy 101: State vs. Federal Regulation of Stablecoin Issuers

It’s not either Stablecoins or CBDCs. It’s both.

In the last year, stablecoins have exploded to a total market capitalization of $160 billion at heights. Simultaneously, central banks around the world are beginning to research and test the potential for central bank digital currencies (CBDCs).

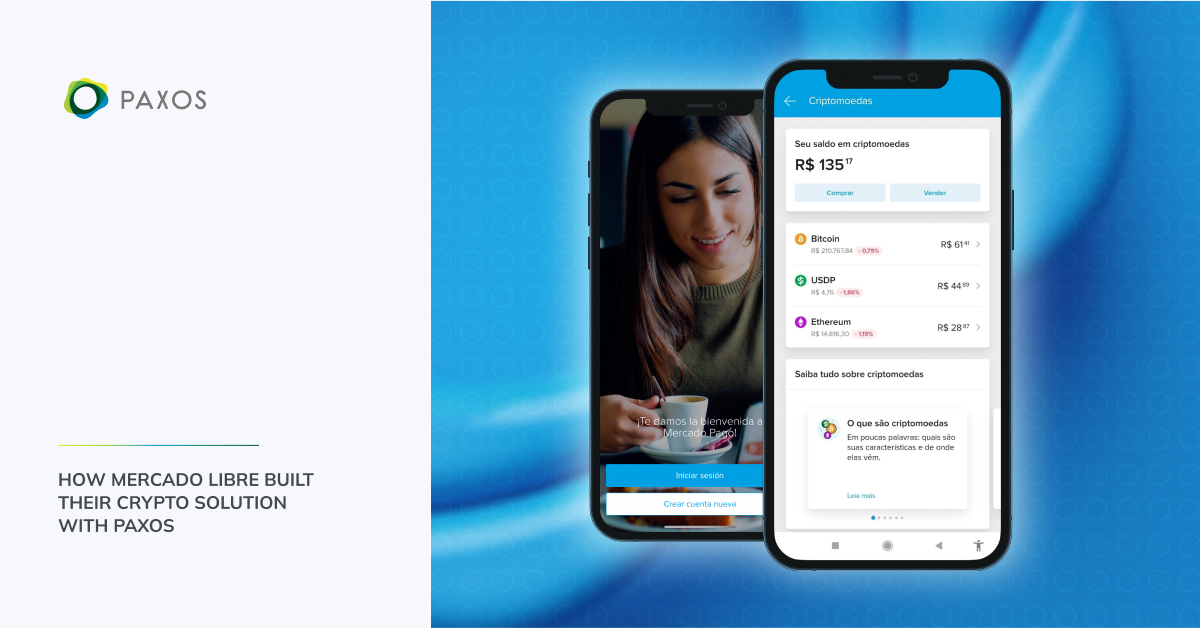

Learn How Mercado Libre Built Their Crypto Solution with Paxos

As Latin America’s leading e-commerce technology company, Mercado Libre is focused on democratizing access to commerce and financial services in a region with a high percentage of underbanked individuals.

Transparency and Trust in Paxos-Issued Stablecoins

The most important features of any financial product are its clarity, certainty and transparency. These features define both its utility and its safety. In the case of stablecoins, users should know what they own and outside observers should have a window into the activities of any firm holding reserves. Paxos follows the NYDFS guidelines for portfolio management at all times.

Paxos Takes Unprecedented Step to Increase Transparency in Stablecoin Industry – Introducing USDP & BUSD Monthly Reserves Holding Reports

I’ve spent a lot of time in the last three months talking, writing and educating about stablecoins. The main takeaway I’ve focused on is that stablecoins – as a financial product – are really nothing new.

Don’t Let Market Volatility & Headlines Dissuade You – Web 3.0 is Still the Most Exciting Space and Presents the Biggest Opportunity

Paxos is a regulated blockchain infrastructure provider and we’re focused on building the platform that will power the future of finance. We’re committed to continuing to grow our team, with most hiring efforts focused in the Product and Engineering functions.

“We Don’t Want Financial Instability, We Want Financial Innovation”: Paxos CEO Charles Cascarilla on NY1

The current market environment has exposed that many of the blockchain-related developments of the last years are no different than the risky financial products of the past. Opaque leverage is to blame in many crypto crashes, just like it was to blame in the financial crisis of 2008.

New Report: What Today’s Retail Investors Think About Gold

Paxos surveyed 1,000 adults in the US, UK, Singapore and Germany who have purchased some form of gold – be it ETFs, physical bars, gold coins or tokenized gold in the past two years – to understand their attitudes about the market, their motivations, and their thoughts on the future.

Paxos Engineers Take Consensus!

Paxos Software Engineers, Liz Rodan and Aileen Huang, chose to use part of their L&D budget to attend Consensus, one of the largest events for crypto, investing, NFTs, DeFi, regulation, Web 3 and the metaverse in Austin, TX.

Deciphering the Market: Charles Cascarilla Breaks Down Crypto Volatility on CNBC’s Squawk on the Street

On June 17, 2022, Paxos CEO & Co-Founder Charles Cascarilla joined CNBC’s David Faber and Carl Quintanilla to break down crypto markets. Listen to Charles’ perspective and why he think Paxos is well-positioned to succeed.

Paxos Was Built to Protect its Customers

Paxos Trust Company LLC (“Paxos Trust”) is a regulated financial institution with a primary prudential regulator, which means that every aspect of our operations –

Everything Old is New Again

When I started my career in finance, one of the first realizations I had was that almost nothing was new. A “new” product in finance was almost always a resurrection of an old product or a retrofitting of an existing product to a new application. Truly new products were exceptionally rare.

Offer Your Clients a Comprehensive Wealth Management Solution: Introducing Financial Advisor Crypto Trading for Broker-Dealers

In 2021, survey data revealed that only 15% of financial advisors were allocating crypto in client accounts. But 94% of financial advisors received questions about crypto from clients.

Charles Cascarilla Talks Crypto Price Action and Importance of Regulation on Bloomberg Crypto

When crypto markets are in upheaval, analysts turn to market experts to give perspective on current conditions. Charles Cascarilla turned from equity market investing to focus on crypto soon after the first bitcoin was mined.

“The Everything Bubble” – Hear Paxos CEO Charles Cascarilla’s Perspectives on the Current State of the Global Economy

Paxos has been at the forefront of crypto and blockchain technology since the market’s inception. However, Paxos was also founded with a deep understanding of and expertise in traditional financial services.

Crypto is Going Mainstream: Learn How to Launch it in Your Own Product

The largest institutions in the world now offer crypto products and capabilities to their customers, demonstrating that crypto is no longer a fleeting trend, but a mainstay in the global economy.