A digital token, backed by physical gold

PAXG offers investors a cost-effective way to own investment-grade physical gold with all the benefits of the blockchain. Each Pax Gold (PAXG) token is backed by one fine troy ounce of gold, stored in LBMA vaults in London. If you own PAXG, you own the underlying physical gold, held in custody by Paxos Trust Company.

Cost-efficient

Paxos offers PAXG at a lower cost structure than that of other gold tokens, gold ETFs and LBMA 400 t oz bars, with a low minimum purchase amount and zero storage fees.

Secure and regulated

The allocated gold that backs PAXG is custodied in LBMA vaults and audited monthly. Paxos is a trust company and custodian regulated by the Office of the Comptroller of the Currency (OCC).

No settlement risk

Purchasing PAXG is free from settlement and credit risk, with near instantaneous settlement in addition to T+2 (versus only T+2 for Gold ETFs and LBMA bars).

Redeemable

PAXG is the only gold token you can redeem for LBMA-accredited Good Delivery gold bullion bars. Institutional customers can also redeem for unallocated Loco London Gold. Redeem for USD at current gold market prices at any time.

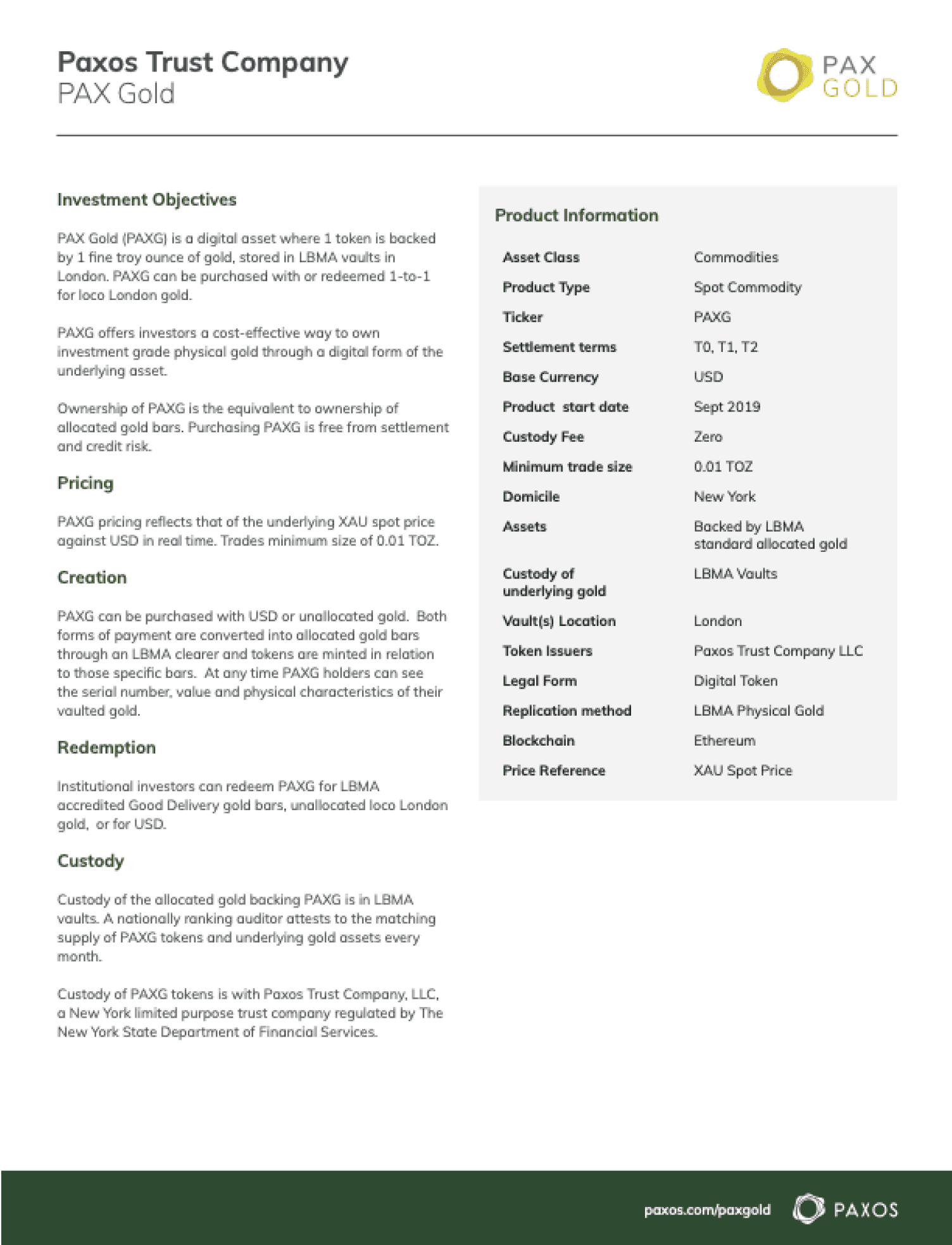

Pax Gold Onesheet

Download our one sheet for institutional investors.

Pax Gold White Paper

Learn more about Pax Gold in our white paper.

*Typical on-chain transactions for Pax Gold moving on Ethereum settle near instantly. When you create PAXG on the Paxos platform, tokens will typically be minted and delivered the same day (some larger transactions will settle the next business day).

FAQ

Review frequently asked questions about Pax Gold (PAXG). For more information view the Pax Gold (PAXG) user guide.

Contact Us

Are you an institutional investor seeking to purchase PAXG? Please contact our sales team.

If you are an existing customer, visit the support center.