At Paxos, we have a mission to open the financial system by making it possible to move assets instantly, in a trustworthy way. We’ve long believed in the power of stablecoins as a critical part of that mission, which is why we’re excited to share more about our new Stablecoin Payments capabilities.

Why Payments Providers are Choosing Stablecoins

Stablecoin payments unlock benefits for payments providers, marketplaces, software platforms and retailers across the full payment flow.

-

Reaching new audiences

Stablecoin payments make it easier to reach global customers and navigate the complexities of international payments with a single, borderless payment option that’s accessible to buyers around the world. Following Stripe’s launch of stablecoin payments in October 2024, they saw pay-ins from over 70 countries in just 24 hours.

It’s critical for payments providers to stay ahead of evolving consumer preferences, and the growing popularity of stablecoins makes them an increasingly important addition to the payment stack.

Stablecoins are growing in popularity and finding particular appeal in global markets as regulation clarifies and use-cases expand. There are over 90 million global wallets holding stablecoins, up over 15% from 2023 into 2024 according to data from RWA.

-

More cost effective payments

Payment fees for credit cards and wallets can often reach up to 3% or more, depending on the location and type of businesses involved. And that’s before adding in the extra fees associated with accepting international payments, converting to local currencies and more.

Stablecoin payments can represent a 50% or more cost reduction to PSPs and merchants compared to traditional payment methods. The emergence of low-cost, faster chains like Solana & Polygon, has brought down transaction costs and gas fees, making stablecoins an attractive alternative to traditional options.

-

Fast, streamlined settlement

Settlement times for traditional payment methods can often take days, as card transactions are confirmed across networks and issuers and bank payments pass across clearinghouses and correspondent neworks. And depending on the payment method, those settled transactions are still open to chargeback and dispute issues for 30-90 days.

Stablecoins offer near-instant settlement, with funds moving from a customer to a merchant or platform wallet in seconds, and give companies more flexibility with their capital. Plus, stablecoin payments reduce the complexity of payments with a no-dispute payment flow, offering users more certainty while still retaining flexibility to offer refunds

How Paxos Can Help

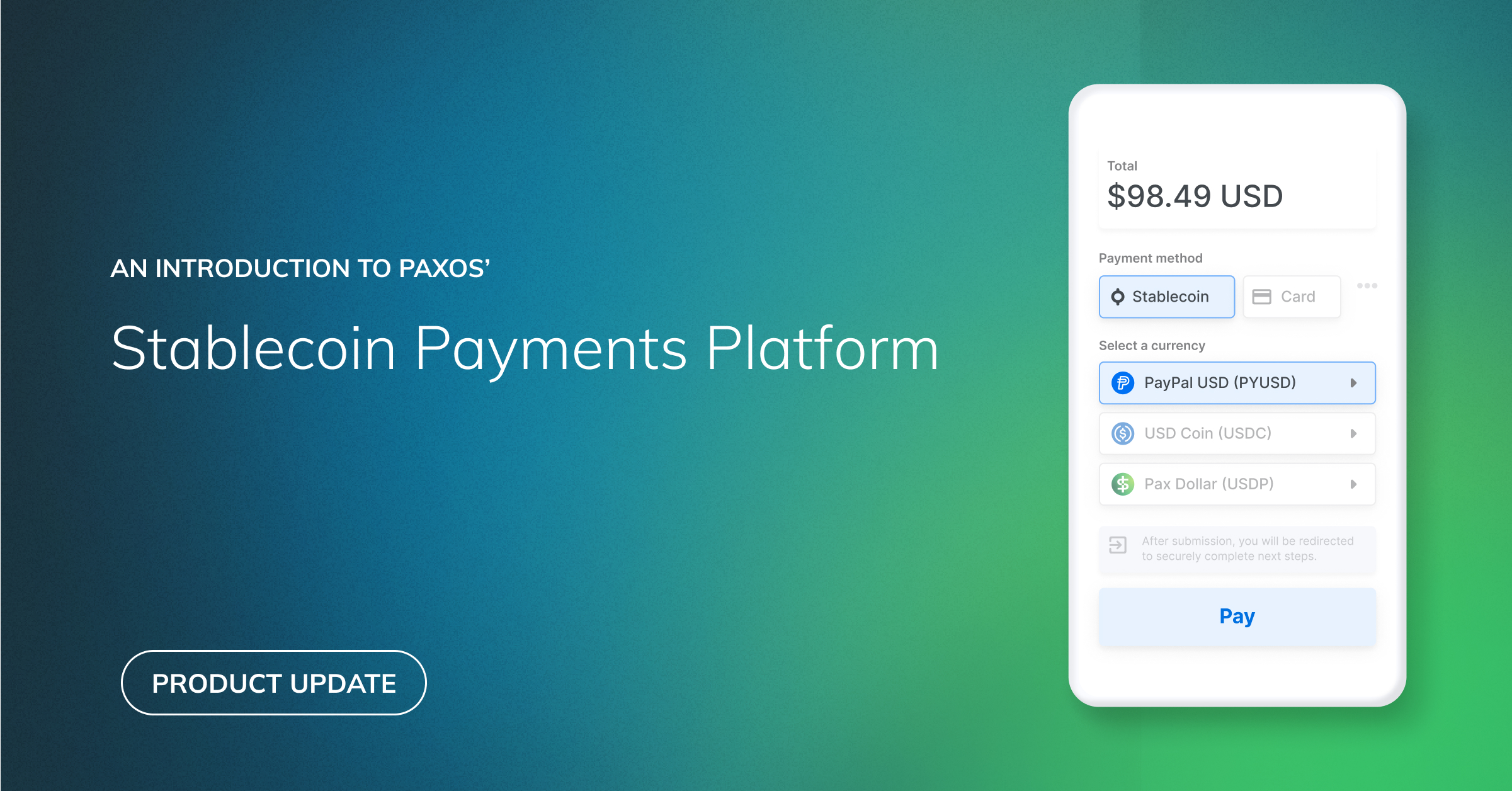

Paxos’ new Stablecoin Payments platform unlocks seamless pay-ins and payouts of stablecoins for payments providers and merchants through:

- Streamlined onboarding: Paxos lets payments platforms leverage existing onboarding and data flows for merchant setup, making it easier than ever to expand payment options

- Instant conversion: Our platform is designed to help you instantly convert payments between stablecoins and fiat (USD), giving businesses flexibility in how they want to be paid and ensuring easy access to the assets you need for payouts

- Seamless expansion: Our infrastructure lets you move faster by leveraging a complete stack from onboarding to fiat conversion to built-in regulatory compliance, with 30+ countries available from a single integration.

Learn more in the docs, or if you want to get started with Paxos’ Stablecoin Payments, get in touch!